Dibba.aiv3

37

Overview

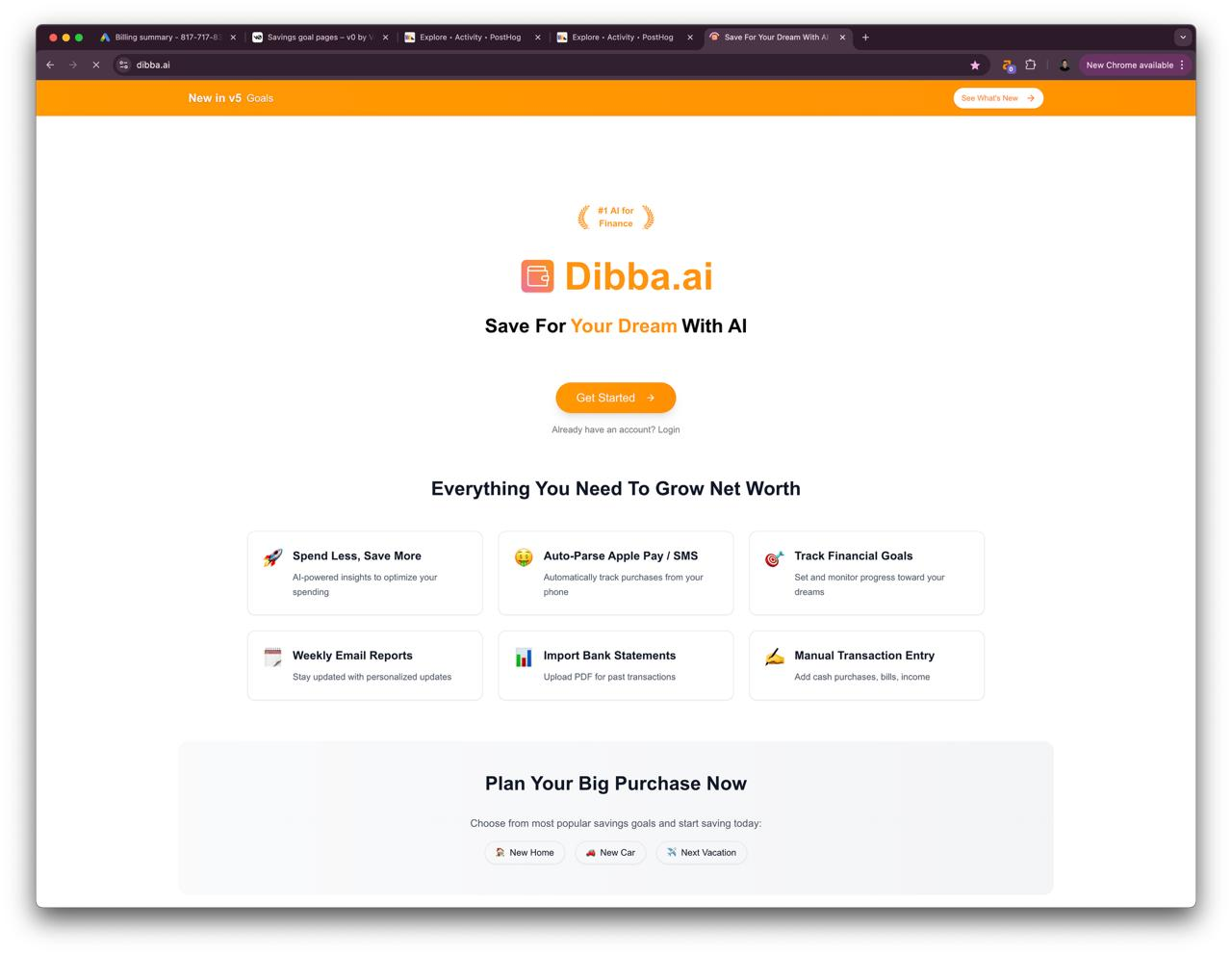

- Eliminate money waste automatically with AI expense tracking from Apple Pay and banking SMS

- Stay on track with daily, weekly, and monthly financial check-ins through scheduled email reports

- Receive personalized savings goals tailored to your spending habits and financial preferences

- Get accurate savings predictions through continuous expense monitoring and pattern analysis

- Secure your financial data without connecting bank accounts using SMS message processing

- Develop lasting financial habits with clear spending pattern visualization and smart insights

- Achieve wealth accumulation faster with category-specific money-saving tips and goal tracking

Pros & Cons

Pros

- Security-first approach

- No need for bank details

- SMS based expense tracking

- Smart insights on expenditures

- Personalized savings goal setting

- Automated savings goal based on habits

- Accurate saving predictions

- Clear view of financial health

- Money-saving tips based on habits

- Doesn't require bank connection

- Aids in wealth accumulation

- Facilitates good financial habits

- Confidential data remains secure

- Long-term financial benefits

- Transforms financial management practices

- Finance management akin to personal advisory

- Hassle-free use

- Helps in savings efficiency

Cons

- Reliant on SMS for tracking

- No bank account integration

- Assumptions based on spending habits

- Could miss non-SMS transactions

- Potentially inaccurate savings predictions

- Depends on user's financial habits

- No physical evidence of savings

- May not cover all expenditures

- Limited personal financial advisor insights

Reviews

Rate this tool

Loading reviews...

❓ Frequently Asked Questions

Dibba uses AI to intelligently process banking SMS messages and track expenses. Based on this, it categorizes transactions and provides smart insights to help users manage their finances and optimize savings. Its AI algorithms also allow for personalized savings goal setting, based on the user's financial habits and preferences. Indeed, Dibba's AI-driven operations offer keen financial insights and money-saving tips, effectively affording users an experience analogous to having a personal financial advisor.

Dibba utilizes its SMS message processing feature to securely track user expenses. Instead of requiring users to share their bank account details, Dibba processes banking SMS messages, ensuring that user's financial data remains secure while simultaneously offering continuous expense monitoring.

Transactions in Dibba are categorized by its AI algorithms. They analyze the inputs from banking SMS and discern expenditure patterns. These categories are then used to provide relevant money-saving tips and insights, making it easier for users to understand and manage their spending habits.

Dibba aids in maximizing savings by providing users with insights into their spending patterns, allowing them to avoid unnecessary expenditures. Through continuous monitoring of expenses and accurate predictions of potential savings, Dibba encourages effective financial habits and goal-oriented saving. Moreover, its AI-based operation presents money-saving tips according to user's spending habits and expenditure categories.

Dibba's personalized savings goals are set using its AI algorithms, which analyse user's financial habits and preferences. By monitoring expenses and tracking spending patterns, Dibba enables automated savings goal setting that is tailored to each user's unique financial situation and aspirations.

Dibba's savings predictions are incredibly accurate due to its continuous monitoring of expenses and analysis of expenditure patterns. The testimonials from users attest to this accuracy, describing Dibba's insights as akin to those of a personal financial advisor.

Dibba guides users towards wealth accumulation through continuous expense tracking and personalized savings goal setting. By offering accurate predictions of potential savings and giving relevant money-saving tips, Dibba assists users in avoiding unnecessary expenditures, thereby gradually increasing their wealth over time.

Dibba offers money-saving tips based on the categories of spending detected by its AI algorithms. These smart insights help users identify areas where they can reduce expenditure, maximize savings, and ultimately accumulate wealth more effectively and efficiently.

No, it is not necessary to connect a bank account to use Dibba. Transaction tracking is carried out securely via processing of banking SMS messages, thereby eliminating the need for users to share their sensitive bank account details.

Dibba adopts a security-first stance, ensuring the user's financial data remains secure at all times. It accomplishes this by avoiding direct connection with users' bank accounts and processing banking SMS messages instead for tracking expenses. This unique approach secures user's data while providing vital insights into spending habits.

Yes, Dibba provides financial management advice using insights derived from AI-based transaction categorization and expense tracking. These insights are described as being akin to having a personal financial advisor, making valuable suggestions and offering relevant money-saving tips to users.

Dibba is considered highly user-friendly owing to its non-intrusive method of data collection and easy-to-understand categorization and visualization of financial information. Users appreciate the seamless experience of gaining deeper insights into their spending without needing to connect their bank accounts or sift through complex data points.

User testimonials attribute Dibba's utility to its capability in transforming personal finance management practices. Users have commended its performance akin to a personal financial advisor, its help in the development of good financial habits, and its efficiency in helping them save effectively and achieve their financial goals.

Dibba contributes to the development of good financial habits by providing users with a clear view of their spending patterns. With the help of insights derived from AI-based categorization and prediction, users can identify unnecessary expenditures and make informed decisions to promote effective savings habits.

Dibba demonstrates high efficiency in aiding users to save money, as attested by its users, who report saving more effectively and achieving their savings goals faster. This is accomplished through continuous tracking of expenses, accurate predictions of potential savings, and offering relevant money-saving tips based on spending habits.

Yes, Dibba operates solely based on banking SMS, eliminating the need for users to share their bank account details. This feature allows for secure and efficient tracking of expenses, categorizing transactions, and providing the financial insights necessary for improved saving habits and wealth accumulation.

The long-term benefits of using Dibba include developing improved financial habits, effectively managing personal finances, saving money more efficiently, and accelerating wealth accumulation. Dibba's AI-driven system provides valuable insights and tips, helping users make informed financial decisions and achieve their financial goals more effectively.

Dibba uses AI to ensure savings efficiency by continuously monitoring expenses, categorizing transactions based on spending habits, and providing smart insights to avoid unnecessary expenditures. Based on these, it also offers accurate predictions for potential savings, aiding users in effectively managing and optimizing their savings.

The automated savings goals feature of Dibba works by using AI algorithms to understand the user's financial habits and preferences. Based on these factors, it sets personalized savings goals, promoting better savings efficiency and financial management.

In Dibba, expenses are categorized using AI algorithms that process banking SMS messages. By discerning the nature of each transaction, expenses are categorized into different groups which then become the basis for generating personalized tips, goal setting, and financial insights.

Dibba guides users towards wealth accumulation through continuous expense tracking and personalized savings goal setting. By offering accurate predictions of potential savings and giving relevant money-saving tips, Dibba assists users in avoiding unnecessary expenditures, thereby gradually increasing their wealth over time.

Dibba offers money-saving tips based on the categories of spending detected by its AI algorithms. These smart insights help users identify areas where they can reduce expenditure, maximize savings, and ultimately accumulate wealth more effectively and efficiently.

No, it is not necessary to connect a bank account to use Dibba. Transaction tracking is carried out securely via processing of banking SMS messages, thereby eliminating the need for users to share their sensitive bank account details.

Dibba adopts a security-first stance, ensuring the user's financial data remains secure at all times. It accomplishes this by avoiding direct connection with users' bank accounts and processing banking SMS messages instead for tracking expenses. This unique approach secures user's data while providing vital insights into spending habits.

Yes, Dibba provides financial management advice using insights derived from AI-based transaction categorization and expense tracking. These insights are described as being akin to having a personal financial advisor, making valuable suggestions and offering relevant money-saving tips to users.

Dibba is considered highly user-friendly owing to its non-intrusive method of data collection and easy-to-understand categorization and visualization of financial information. Users appreciate the seamless experience of gaining deeper insights into their spending without needing to connect their bank accounts or sift through complex data points.

User testimonials attribute Dibba's utility to its capability in transforming personal finance management practices. Users have commended its performance akin to a personal financial advisor, its help in the development of good financial habits, and its efficiency in helping them save effectively and achieve their financial goals.

Dibba contributes to the development of good financial habits by providing users with a clear view of their spending patterns. With the help of insights derived from AI-based categorization and prediction, users can identify unnecessary expenditures and make informed decisions to promote effective savings habits.

Dibba demonstrates high efficiency in aiding users to save money, as attested by its users, who report saving more effectively and achieving their savings goals faster. This is accomplished through continuous tracking of expenses, accurate predictions of potential savings, and offering relevant money-saving tips based on spending habits.

Yes, Dibba operates solely based on banking SMS, eliminating the need for users to share their bank account details. This feature allows for secure and efficient tracking of expenses, categorizing transactions, and providing the financial insights necessary for improved saving habits and wealth accumulation.

The long-term benefits of using Dibba include developing improved financial habits, effectively managing personal finances, saving money more efficiently, and accelerating wealth accumulation. Dibba's AI-driven system provides valuable insights and tips, helping users make informed financial decisions and achieve their financial goals more effectively.

Dibba uses AI to ensure savings efficiency by continuously monitoring expenses, categorizing transactions based on spending habits, and providing smart insights to avoid unnecessary expenditures. Based on these, it also offers accurate predictions for potential savings, aiding users in effectively managing and optimizing their savings.

The automated savings goals feature of Dibba works by using AI algorithms to understand the user's financial habits and preferences. Based on these factors, it sets personalized savings goals, promoting better savings efficiency and financial management.

In Dibba, expenses are categorized using AI algorithms that process banking SMS messages. By discerning the nature of each transaction, expenses are categorized into different groups which then become the basis for generating personalized tips, goal setting, and financial insights.

Pricing

Pricing model

No Pricing