Overview

- Identify ideal investor matches automatically using AI that analyzes your deal specifics to find compatible funders

- Personalize investor outreach at scale with GPT-powered email scripts that create meaningful, tailored communications

- Secure your entire fundraising process with private deal rooms that protect sensitive documents and due diligence materials

- Accept investments seamlessly through integrated ACH, wire transfers, and check processing within your secure deal room

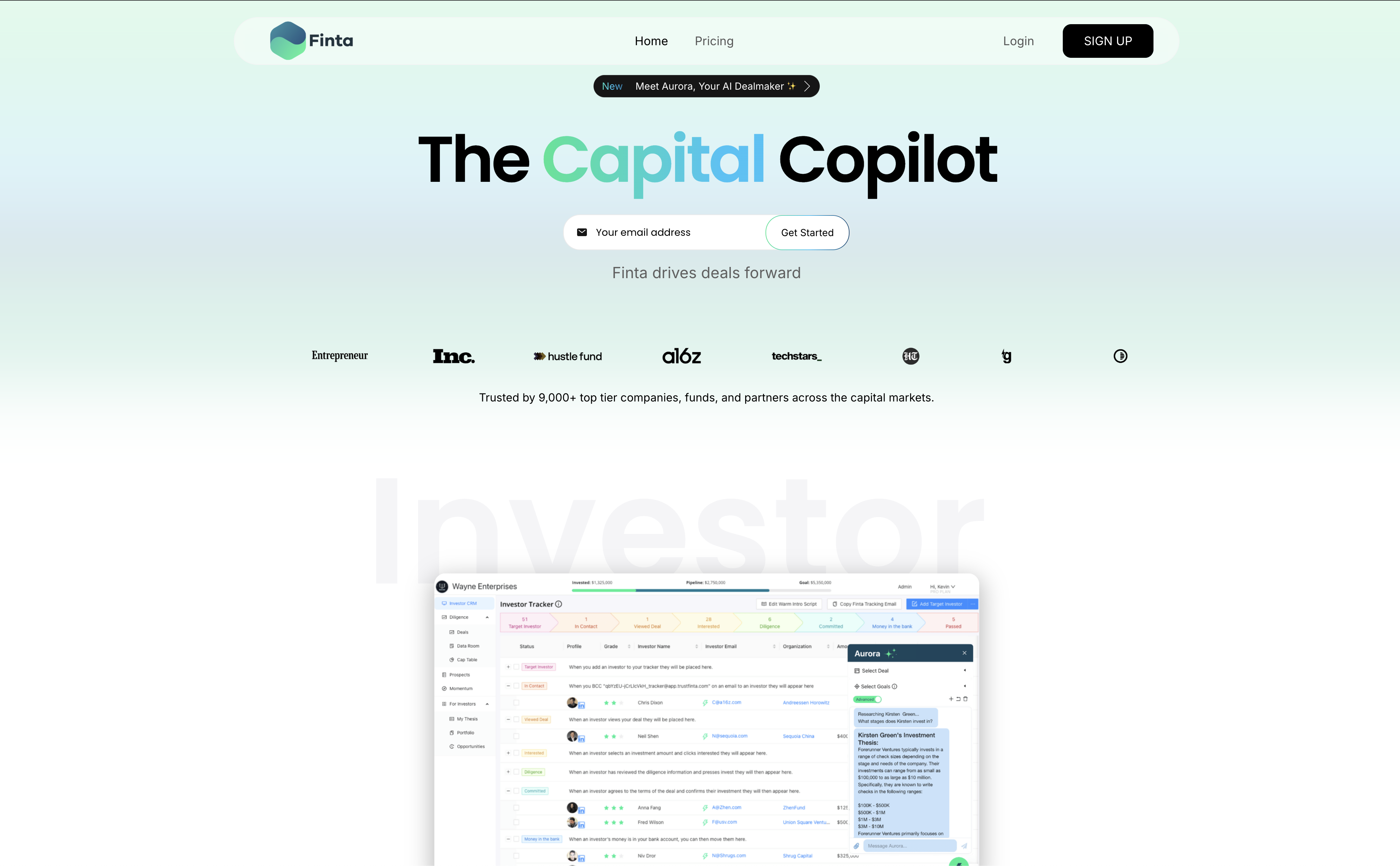

- Track investor engagement in real-time with CRM insights that show who's viewing your materials and for how long

- Manage complex equity structures effortlessly with cap table management supporting multiple share classes and option pools

- Accelerate investor due diligence with customizable virtual data rooms that streamline document sharing and updates

- Automate your fundraising workflow from prospecting to close with integrated tools that eliminate manual coordination

Pros & Cons

Pros

- Secure and shareable deal rooms

- Private link-sharing of rooms

- GPT-3 personalization of email scripts

- Automated investor prospecting

- Extensive investor database

- Filterable investor matches

- Cap table management

- Support for multiple shares classes

- Employee stock option pool management

- Convertible securities handling

- Warrant management

- Quick setup for founders

- Private link-sharing for investment

- Investor tracker CRM

- Seamless investment processing

- Variety of fund transfer methods

- Virtual data room

- Secure document sharing

- Real-time notifications

- Insights on deal room engagement

- Easy-to-use platform

- Automated fundraising workflow

- Shareable deal link

- Investor outreach launching

- Personalized investor interactions

- Secure fund transfer methods

- Supports various equity types

- Real-time security permissions

- Any terms handling

Cons

- No mobile app

- Limited payment options

- No direct integration with banks

- No multi-language support

- No custom branding options

- Dependent on GPT-3 technology

- No offline mode

- Investor databases not customizable

- No trial period

- Lacks advanced security features

Reviews

Rate this tool

Loading reviews...

❓ Frequently Asked Questions

Finta for Fundraising is an AI-powered tool that automates the entire workflow of fundraising for businesses. It provides secure, shareable deal rooms for companies, integrates GPT-3-powered CRM for creating meaningful investor interactions, and utilizes AI to prospect potential investors. The platform also supports various equity management features and enables secure investment fund transfers. Finta also offers a virtual data room for secure document sharing, complete with real-time notifications and data insights.

Finta AI operates on several fronts. For investor relations, it uses GPT-3 technology to create personalized email scripts, driving the investment funnel smoothly. In prospecting potential investors, Finta AI automatically uses the deal information provided to identify the best matches. It also aids in equity management and streamlines the secure transfer of investment funds.

GPT-3 is used by Finta for creating meaningful investor interactions and driving the business's investment funnel forward. It accomplishes this by creating AI-personalized email scripts. These scripts facilitate effective communication with potential investors, making their interactions personalized and meaningful.

Finta's deal room serves as a one-stop, shareable link where founders can privately share all necessary documents and information needed for investor diligence. The users can track and improve the potential investors' interest using Finta's CRM. In addition, the deal room facilitates the secure and seamless transfer of investment funds.

Yes, Finta can facilitate secure fund transfers. The platform allows companies to accept investments through simple ACH, checks, or wire transfers, ensuring a secure and seamless process. These transactions occur in the deal room, offering both privacy and convenience.

Finta's investor matching feature uses AI to utilize the deal information and prospect the best investors for the company's offering. It presents a database of investors, helping businesses find the most compatible funders for their specific needs.

Finta for Fundraising can be used by any companies and start-ups looking to automate and streamline their fundraising efforts. It's designed to help founders and investors manage investor relations, share pertinent information securely, enable seamless investment processing, and manage equity.

Finta's email scripting operates with the help of GPT-3 technology. By creating AI-personalized email scripts, Finta ensures that the communication with potential investors is more personalized, efficient, and meaningful, enhancing the prospecting and fundraising process.

Finta's investor database can be filtered based on various parameters. While the specifics of these parameters are not detailed in their website, the aim is to help to identify the investors most suited to a company's specific needs or offering.

Finta's equity management capabilities extend to cap table management, supporting different classes of shares, maintaining an employee stock option pool, converting convertibles, warrants, and more. It organizes and controls all aspects related to equity, making the process more efficient.

Setting up on Finta involves using the quick setup option. Founders can upload their pitch deck with as much or as little information as required. From there, they can share their deal link privately, invite interested investors, and manage their investments and equity through the platform.

Finta's virtual data room allows for secure document sharing, with real-time notifications and security permissions. It also provides insights such as the time spent in the deal room. This feature allows companies to share due diligence documents securely while maintaining a clear overview of activity within the room.

Finta offers insights into potential investors' behavior and interest. The specifics of these insights aren't elaborated on the website, but these are likely derived from their activity within the secure deal room and their interaction with the materials provided.

Yes, founders can customize the information they want to share on Finta. When preparing the deal, the founder can upload their pitch deck with as little or as much information as they'd like. The level of detail shared can be tailored to suit the company's unique needs and strategy.

Finta's CRM tracker helps users track and improve the potential investors' interest. It serves as a mission control for all investor relations, giving the user a comprehensive view of their interactions with investors and helping them drive their fundraising efforts effectively.

Finta automates fundraising workflows through its AI capabilities. It streamlines the process of investor relations, investor matching, fund transfers, and equity management. The platform also ensures secure document sharing, real-time notifications, and insightful data analytics, making the fundraising process more efficient and less labor-intensive.

Document sharing in Finta occurs within secure deal rooms. Founders can share essential documents for diligence securely with potential investors. Finta also provides real-time notifications of any actions or changes within these rooms, ensuring that all parties are promptly updated.

The types of documents shared through Finta's deal room can vary depending on the business's needs. Typically, these include all necessary documents and information for investor diligence.

Finta does support different types of shares. The platform's equity management features include support for multiple classes of shares, in addition to managing an employee stock option pool, convertibles, and warrants.

Finta helps with pitching to potential investors by creating an effective platform for sharing all necessary details for due diligence. It uses GPT-3 technology to create personalized email scripts, ensuring effective communication. Finta also uses AI to identify potential investor matches and track their interest, making the pitching process more efficient and targeted.

Finta for Fundraising can be used by any companies and start-ups looking to automate and streamline their fundraising efforts. It's designed to help founders and investors manage investor relations, share pertinent information securely, enable seamless investment processing, and manage equity.

Finta's email scripting operates with the help of GPT-3 technology. By creating AI-personalized email scripts, Finta ensures that the communication with potential investors is more personalized, efficient, and meaningful, enhancing the prospecting and fundraising process.

Finta's investor database can be filtered based on various parameters. While the specifics of these parameters are not detailed in their website, the aim is to help to identify the investors most suited to a company's specific needs or offering.

Finta's equity management capabilities extend to cap table management, supporting different classes of shares, maintaining an employee stock option pool, converting convertibles, warrants, and more. It organizes and controls all aspects related to equity, making the process more efficient.

Setting up on Finta involves using the quick setup option. Founders can upload their pitch deck with as much or as little information as required. From there, they can share their deal link privately, invite interested investors, and manage their investments and equity through the platform.

Finta's virtual data room allows for secure document sharing, with real-time notifications and security permissions. It also provides insights such as the time spent in the deal room. This feature allows companies to share due diligence documents securely while maintaining a clear overview of activity within the room.

Finta offers insights into potential investors' behavior and interest. The specifics of these insights aren't elaborated on the website, but these are likely derived from their activity within the secure deal room and their interaction with the materials provided.

Yes, founders can customize the information they want to share on Finta. When preparing the deal, the founder can upload their pitch deck with as little or as much information as they'd like. The level of detail shared can be tailored to suit the company's unique needs and strategy.

Finta's CRM tracker helps users track and improve the potential investors' interest. It serves as a mission control for all investor relations, giving the user a comprehensive view of their interactions with investors and helping them drive their fundraising efforts effectively.

Finta automates fundraising workflows through its AI capabilities. It streamlines the process of investor relations, investor matching, fund transfers, and equity management. The platform also ensures secure document sharing, real-time notifications, and insightful data analytics, making the fundraising process more efficient and less labor-intensive.

Document sharing in Finta occurs within secure deal rooms. Founders can share essential documents for diligence securely with potential investors. Finta also provides real-time notifications of any actions or changes within these rooms, ensuring that all parties are promptly updated.

The types of documents shared through Finta's deal room can vary depending on the business's needs. Typically, these include all necessary documents and information for investor diligence.

Finta does support different types of shares. The platform's equity management features include support for multiple classes of shares, in addition to managing an employee stock option pool, convertibles, and warrants.

Finta helps with pitching to potential investors by creating an effective platform for sharing all necessary details for due diligence. It uses GPT-3 technology to create personalized email scripts, ensuring effective communication. Finta also uses AI to identify potential investor matches and track their interest, making the pitching process more efficient and targeted.

Pricing

Pricing model

Freemium

Paid options from

Free tier available

Billing frequency

Monthly