RiskInMind AI

80

Overview

- Automate regulatory compliance with continuous monitoring that identifies compliance gaps before they become violations

- Accelerate loan decisions with AI-powered risk assessment that analyzes applicant data in sub-seconds

- Generate error-free compliance documents automatically, eliminating manual paperwork and reducing administrative workload

- Monitor portfolio risk in real-time with predictive analytics that alert you to market shifts before they impact your assets

- Conduct scenario-based stress testing to validate investment strategies against potential market downturns

- Maintain 99.7% risk detection accuracy across all operations while processing complex financial data at enterprise scale

Pros & Cons

Pros

- Streamlines operational efficacy

- Enhances loan assessment procedures

- Analyzes and interprets applicant data

- Signals potential risks and benefits

- Fast and informed decision making

- Regulatory compliance capabilities

- Mitigates legal and reputational risks

- Automates document generation

- Improves administrative efficiency

- Integrated solution for risk management

- Data-driven decisions support

- Intelligent assessment of financial risk

- Reduces mistake in document generation

- Keeps business operations standard compliant

- Fast scrutiny of financial data

- Supports modern financial institutions

Cons

- Lacks real-time risk analysis

- No multi-language support

- No integration with external databases

- No predictive financial forecasting

- No mobile accessibility

- No customizable interface

- Lacks comprehensive training modules

- No API for integration

- Missing third-party audit feature

- Lacks offline functionality

Reviews

Rate this tool

Loading reviews...

❓ Frequently Asked Questions

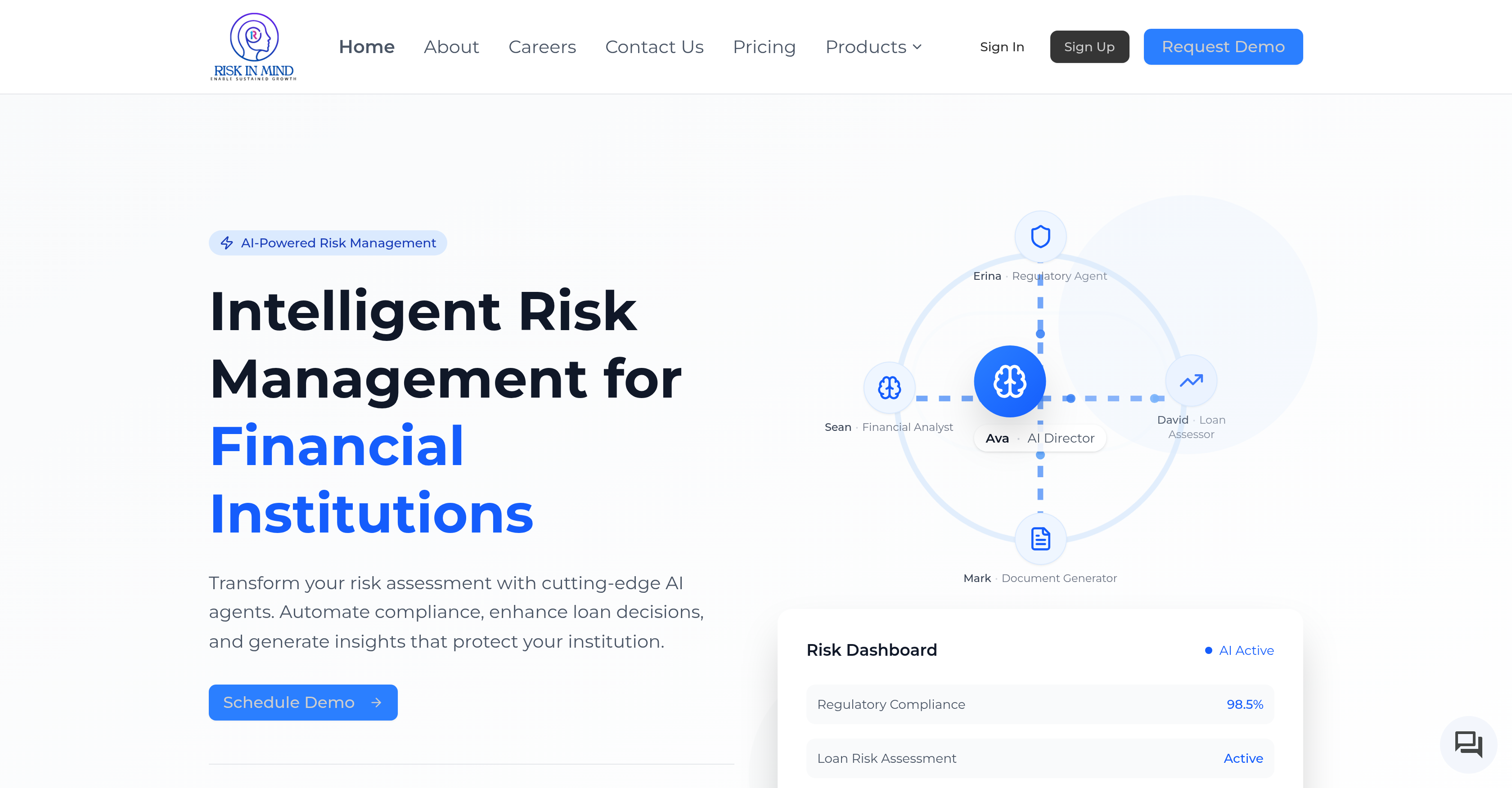

RiskInMind is an AI-powered risk management platform for financial institutions, designed to automate compliance, assess credit risk, generate regulatory documents, and provide predictive market insights.

It operates through specialized AI agents, such as Erina (compliance), David (loan assessor), Sean (financial analyst), and Mark (document generator), all coordinated by Ava, the AI Risk Director. Each agent is trained to handle specific tasks, providing end-to-end risk coverage.

The platform delivers 99.7% risk detection accuracy with sub-second processing speeds and continuous monitoring, ensuring high reliability for critical operations.

Yes. Mark, the document generation agent, creates regulatory filings, compliance reports, and customizable templates to streamline documentation.

RiskInMind uses bank-grade, end-to-end encryption and complies with financial security standards to ensure enterprise-grade data protection.

The platform is trusted by leading banks, credit unions, and financial institutions looking to enhance decision-making, reduce compliance risk, and accelerate operations.

No. Instead, it augments staff by automating repetitive, high-volume tasks, freeing human teams to focus on higher-value decision-making and oversight.

No. Instead, it augments staff by automating repetitive, high-volume tasks, freeing human teams to focus on higher-value decision-making and oversight.

Pricing

Pricing model

Free Trial

Paid options from

$29/month

Billing frequency

Monthly

Related Videos

Introduction to RiskInMind

raj kc•13 views•Jan 22, 2025