Overview

- Log any expense instantly without switching apps by sending a text, voice note, or receipt photo directly in your Telegram chat, powered by natural language processing.

- Receive personalized financial advice and identify savings opportunities based on your unique spending patterns and financial behavior, not generic tips.

- Avoid overspending with custom budget creation and real-time alerts that notify you the moment you approach your preset limits for any category.

- See exactly where your money goes with automatic transaction categorization and visual trend analysis that reveals both obvious and hidden spending habits.

- Track progress toward your savings and investment goals with detailed spending reviews and ongoing financial progress monitoring over time.

Pros & Cons

Pros

- Integrates with Telegram

- Text, voice, image inputs

- Instant expense categorization

- Provides immediate financial insights

- Tailored financial advice

- Automatic transaction logging

- Spending analysis functionality

- Advises based on spending patterns

- Financial planning support

- Spending trend visualization

- Detailed progress tracking

- Personalized financial recommendations

- Daily, weekly financial summaries

- Custom budget creation

- Real-time budget limit alerts

- Helps understand spending patterns

- Track progress towards goals

- Specialized for personal finance

- Natural language processing functionality

- Receipt scanning feature

- Voice interactive feature

- Smart alert system

- Expense tracking via chat

- Visual representation of trends

- Data-driven financial insights

- Product shaped by user feedback

- Financial question assistance

- Savings goal tracking

- Investment decision assistance

- Data encryption for security

- Customizable tracking categories

- Real-time spending pattern identification

- Personalized saving suggestions

- Detailed financial analysis

- Uses user financial data

- Early access for feedback

- Builds financial safety nets

- Promotes investment readiness

- Developed with user experience focus

- Supports multiple input forms

- Easy access via Telegram

- Personalized budget setting

- Helps prevent oversaving/overspending

- Receipt photo auto-extraction

- Quick manual expense entry

Cons

- Only integrates with Telegram

- Only offers text-based interaction

- No multi-currency support mentioned

- Likely non-accessible for visually-impaired

- No clear data export functionality

- Insufficient privacy information

- Monthly subscription needed after trial

- Limited language support presumed

- No integration with banking services

- Waitlist required for access

Reviews

Rate this tool

Loading reviews...

❓ Frequently Asked Questions

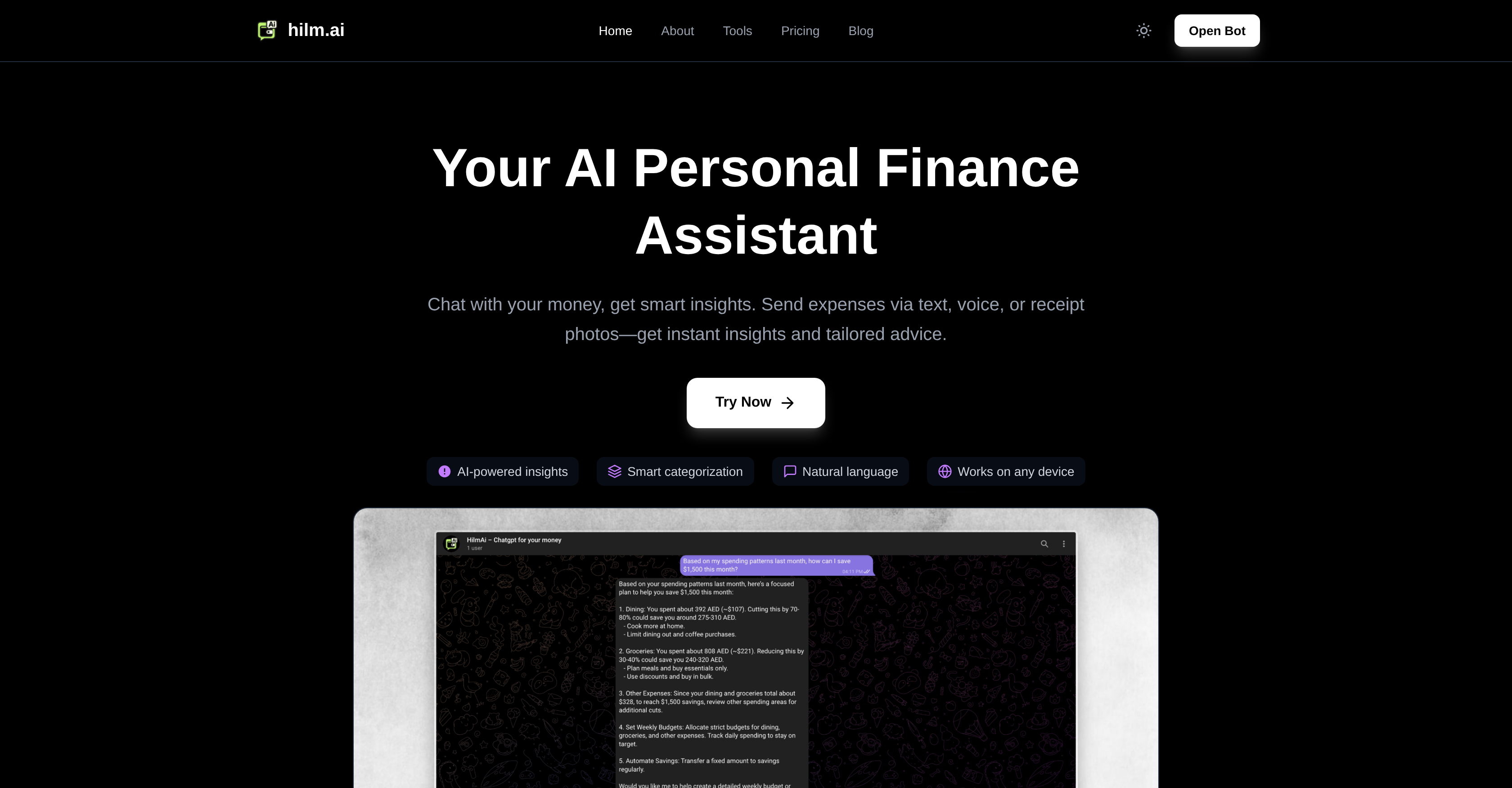

Hilm.ai is an AI Personal Finance Assistant tool. As a specialized AI, it's designed specifically to track and manage personal finances by identifying, categorizing, and logging transactions that users send via text, voice notes, or receipts. Its purpose is to help users understand their spending patterns, track their financial goals, and make informed decisions about saving, spending, and investing. Hilm.ai combines AI-powered natural language processing with financial insights to offer features like spending analysis, financial advice, real-time alerts and custom budget creation.

Hilm.ai integrates with Telegram to facilitate easier access and communication. Users can send their expenses via text messages, voice notes, or receipt photos through this platform, which the AI then processes and logs on their behalf. This connection enhances user-friendliness and accessibility.

Yes, Hilm.ai can identify and log expenses sent through text messages, voice notes, or receipt photos. It uses AI to instantly identify and categorize these expenses. This feature allows users to track and log their transactions easily, providing a more convenient and effective management of personal finances.

The main purpose of hilm.ai is to support users in understanding their spending patterns, tracking their progress towards achieving their financial goals, and making informed decisions about saving, spending, and investing. It assists users by providing personalized financial advice and insights based on their spending habits and financial behavior.

Hilm.ai offers a variety of features designed to support personal finance management. These include automatic transaction logging, spending analysis, financial planning support through spending reviews and trend visualizations, real-time alerts for budget limitations, and personalized financial advice, among others. It also facilitates progress tracking over time to guide users' financial behavior.

Hilm.ai offers spending reviews, trend visualization, and detailed progress tracking to keep users informed about their spending habits. With these features, users can track their expenditures, view their spending trends visually, and monitor their financial progress over time. This comprehensive support assists in effective financial planning and decision-making.

Hilm.ai provides personalized financial recommendations based on users' spending patterns, savings goals, and financial behaviors. These insights help identify potential spending trends, suggest savings opportunities, and deliver a detailed analysis of their overall financial behavior. Hence, users receive tailored advice to support their financial goals.

Yes, Hilm.ai tracks users' progress towards their financial goals. It uses spending reviews, trend visualizations, and ongoing tracking to provide a detailed overview of users' financial behavior and their advancement towards these goals. This functionality aids in more accurate and effective financial planning.

Hilm.ai uses AI and natural language processing to understand and respond to various forms of user input. Whether users express their expenses through text, voice notes, or receipt photos, hilm.ai can process and respond appropriately, logging transactions and providing insights.

Hilm.ai utilizes natural language processing to understand varying forms of user input, whether it's text, voice, or images of receipts. This capability allows it to process different types of data effectively and provide personalized insights and customized solutions for users' personal finance management.

Unlike general-purpose AI, hilm.ai is designed primarily for personal finance management. It offers a specialized and customized AI-powered service which includes features like expense tracking, spending analysis, personalized financial advice, and progress tracking towards financial goals. It is integrated with Telegram for ease of use and accessibility, and employs natural language processing to understand and process various forms of input.

Hilm.ai can be used to manage personal finances by automatically logging transactions, analyzing spending, and giving tailored financial advice. Users can send expenses in the form of text, voice notes, or receipt photos, and receive insights based on their spending patterns, savings goals, and financial behavior. Hilm.ai also assists in financial planning by providing spending reviews, trend visualization, and tracking progress over time.

Hilm.ai's automatic transaction logging works by identifying and categorizing transactions sent by users via text, voice notes, or receipt photos. The AI feature instantly captures these expenses and logs them, providing a convenient, automated way to track transactions and monitor personal finances.

Hilm.ai's spending analysis delivers insights by tracking where every dollar flows. It identifies spending patterns and trends over time, offering users personalized advice and guidance based on their financial behavior. This helps users make smarter financial decisions and maintain better control over their financial well-being.

Yes, Hilm.ai has a feature that assists users in creating custom budgets. It provides real-time alerts when users are nearing their defined limits, helping them to monitor and manage their spending effectively and maintain financial discipline.

Hilm.ai's real-time alerts notify you when you are approaching the limits of your customized budget. By providing instant notifications, hilm.ai helps users stay on track with their financial plans and avoid overspending.

Hilm.ai tracks and analyzes users' expenses, thereby helping them understand their spending patterns. By instantly categorizing and logging transactions sent via text, voice notes, or receipt photos, it provides insights into where, how, and on what users are spending their money. This facilitates better control over finances and aids users in adjusting their spending habits if needed.

Yes, hilm.ai is designed to help users make informed financial decisions. By analyzing spending patterns, providing personalized financial advice, and tracking progress towards savings goals, hilm.ai provides a comprehensive overview of users' financial behavior, thereby supporting them in making informed decisions about saving, spending, and investing.

Users should choose hilm.ai for their personal finance management due to its unique features tailored specifically for personal finance. It uses AI-powered insights, natural language processing, and integrates with Telegram. Hilm.ai offers automatic transaction logging, personalized financial advice, real-time budget alerts, and comprehensive spending analysis. It's designed to help users understand their spending patterns and make data-driven decisions, setting it apart from other financial tools.

Hilm.ai works on any device, being accessible via Telegram makes it easy for users to manage their finances on the go. They can send their expenses through text messages, voice notes, or by snapping a photo of a receipt, regardless of the device they are using. This feature promotes convenience and accessibility suitable for modern, busy lifestyles.

Hilm.ai is a specialized Artificial Intelligence powered personal finance assistant tool. It enables users to track and manage their personal finances via an interactive and user-friendly approach. The tool offers functions like expense tracking, spending analysis, personalized financial advice, and budget creation and monitoring. It supports different forms of inputs like text, voice, or images of receipts for expense input and uses natural language processing for comprehension and transaction identification. Hilm.ai is designed with integration with Telegram, making it more accessible for users. One of its unique elements includes providing personal finance advice based on user spending patterns, goals, and behavior, helping users make informed decisions and achieve their financial aims.

Hilm.ai integrates with Telegram to provide an accessible and user-friendly platform for users to track and manage their finances. The integration means that users can input expenditure information, receive insights, and interact with the AI assistant directly within the Telegram platform. Hilm.ai delivers services like transaction logging, insights, advice, spending summaries, and financial reports right in users' Telegram.

Users can submit expenses to hilm.ai through several methods. They can send expenses via text messages, voice notes, and receipt photos. Regardless of the format, hilm.ai is equipped to understand and process this information, logging and categorizing the expenses accordingly for further analysis and advice.

Hilm.ai provides a comprehensive analysis of user spending. It includes automatic transaction logging, where it identifies and categorizes all transactions based on the inputs. It offers spending analysis that reveals visible and underlying spending patterns. Personalized insights regarding savings, investments and expense behavior are provided based on these patterns. Hilm.ai also helps in visualizing financial trends and progress tracking over longer durations.

Hilm.ai offers tailored financial advice to its users, derived from their spending data and behavioral patterns. It provides financial planning support through spending reviews, trend visualization, and detailed progress tracking. Besides, it sends daily and weekly financial summaries, and personalised financial recommendations. Advice includes identifying spending trends, suggesting savings or investment opportunities, and providing detailed financial analysis.

Hilm.ai provides extensive support for financial planning. The tool helps users set and track their financial goals. It offers customized budget creation and constant monitoring with real-time alerts as one approaches their preset limits. It lets users visualize spending trends and track their progress through spending reviews. Daily and weekly financial summaries and tailored financial advice also contribute to comprehensive financial planning.

Hilm.ai uses its AI capabilities to automatically track and categorize transactions. Once a user submits an expense via text, voice note, or image of a receipt, the AI identifies and logs the transaction, then categorizes it for analysis and spending review. This automatic logging and categorization of transactions allow for detailed insights and advice.

Hilm.ai does provide real-time alerts as part of its budget-setting feature. It offers custom budget creation and delivers real-time alerts when a user approaches their budget limit, helping them to manage and control their spending effectively.

Some unique features of hilm.ai include its integration with Telegram for accessibility and ease of use, its ability to comprehend diverse input modes like text, voice, or images, and the application of natural language processing for understanding and interacting with users. Hilm.ai also offers automatic transaction logging, personalized financial advice, visual trend analysis, detailed progress tracking, and personalized real-time alerts – all based on an individual user's financial behavior.

Hilm.ai uses AI to underpin all its functionalities. It utilizes natural language processing for comprehending user inputs across diverse modes, including text, voice, and images, and responds to these inputs in a meaningful way. The AI powers the automatic logging and categorization of transactions, as well as the insightful analysis of spending patterns and generation of personalized financial advice.

The primary goal of hilm.ai is to enable users to better understand their spending patterns, track their progress towards financial goals, and make informed decisions about saving, investing, and spending. Through automatic logging of transactions, detailed financial analysis and personalized financial advice, hilm.ai aims to empower users to take control of their financial future.

By 'Natural Language Processing', hilm.ai refers to the AI's ability to understand and interpret human language as it naturally occurs in speech or text. This ability allows the AI to comprehend, respond to, and interact with varying forms of input from users, making the tool more user-friendly and conversational.

Yes, hilm.ai can assist users in understanding their spending habits. Using AI-powered insights and analysis, it sheds light on both visible and underlying spending patterns. This includes the frequency, categories, and amounts of spending, among other factors. Regular financial summaries, detailed transaction logging, and trend visualization aid the user in gaining a comprehensive understanding of their spending habits.

Hilm.ai assists users in making informed financial decisions by providing them with tailored financial advice. This advice is based on the user's unique spending patterns, savings goals, and overall financial behavior. The detailed tracking, analysis, and personalized insights provided by hilm.ai enable users to make well-informed decisions about their saving, spending, and investing.

Hilm.ai excels against a general-purpose AI in that it offers specialized assistance for personal finance. Unlike general-purpose AI, hilm.ai leverages AI capabilities like natural language processing to understand and respond to user inputs related to finance. Its intelligent solution offers detailed insights into spending patterns and behavior, personalized financial advice, and comprehensive financial planning support.

Hilm.ai is a great solution for managing personal finances because of its specialized and user-focused features. It encompasses automatic logging and categorization of transactions, detailed and insightful spending analysis, tailored financial advice, and customizable budgeting with real-time alerts. Its ability to process various forms of input, use natural language processing, and integrate with Telegram for accessibility adds to its effectiveness in personal finance management.

Hilm.ai provides support for setting and monitoring budgets. It offers a feature that allows users to create custom budgets for different spending categories. Real-time alerts are provided when the user is approaching their set budget limits, helping them stay on track with their financial plan.

While the information provided about hilm.ai doesn't explicitly mention investing insights, the tool does offer personalized financial advice based on users' financial behavior. This could likely include insights and recommendations on investment opportunities and strategies suited to the individual's financial habits, goals, and situation.

The primary difference between hilm.ai and ChatGPT for personal finance lies in their design and functionality. Hilm.ai is a specialized AI personal finance assistant designed explicitly for expense tracking and financial management. In contrast, ChatGPT is a general-purpose AI not intended or equipped for direct financial data access or real-time insights regarding user spending. Hilm.ai automatically categorizes transactions, provides personalized insights based on spending patterns, and offers features like receipt scanning and voice expense logging, which are not provided by a general AI like ChatGPT.

Yes, hilm.ai can function as a voice interactive tool. It accepts input in the form of voice notes as a part of its different input methods. Users can express their expenses through voice notes, and the AI will understand, process, and log the expense details accordingly.

Hilm.ai provides personalized financial recommendations based on users' spending patterns, savings goals, and financial behaviors. These insights help identify potential spending trends, suggest savings opportunities, and deliver a detailed analysis of their overall financial behavior. Hence, users receive tailored advice to support their financial goals.

Yes, Hilm.ai tracks users' progress towards their financial goals. It uses spending reviews, trend visualizations, and ongoing tracking to provide a detailed overview of users' financial behavior and their advancement towards these goals. This functionality aids in more accurate and effective financial planning.

Hilm.ai uses AI and natural language processing to understand and respond to various forms of user input. Whether users express their expenses through text, voice notes, or receipt photos, hilm.ai can process and respond appropriately, logging transactions and providing insights.

Hilm.ai utilizes natural language processing to understand varying forms of user input, whether it's text, voice, or images of receipts. This capability allows it to process different types of data effectively and provide personalized insights and customized solutions for users' personal finance management.

Unlike general-purpose AI, hilm.ai is designed primarily for personal finance management. It offers a specialized and customized AI-powered service which includes features like expense tracking, spending analysis, personalized financial advice, and progress tracking towards financial goals. It is integrated with Telegram for ease of use and accessibility, and employs natural language processing to understand and process various forms of input.

Hilm.ai can be used to manage personal finances by automatically logging transactions, analyzing spending, and giving tailored financial advice. Users can send expenses in the form of text, voice notes, or receipt photos, and receive insights based on their spending patterns, savings goals, and financial behavior. Hilm.ai also assists in financial planning by providing spending reviews, trend visualization, and tracking progress over time.

Hilm.ai's automatic transaction logging works by identifying and categorizing transactions sent by users via text, voice notes, or receipt photos. The AI feature instantly captures these expenses and logs them, providing a convenient, automated way to track transactions and monitor personal finances.

Hilm.ai's spending analysis delivers insights by tracking where every dollar flows. It identifies spending patterns and trends over time, offering users personalized advice and guidance based on their financial behavior. This helps users make smarter financial decisions and maintain better control over their financial well-being.

Yes, Hilm.ai has a feature that assists users in creating custom budgets. It provides real-time alerts when users are nearing their defined limits, helping them to monitor and manage their spending effectively and maintain financial discipline.

Hilm.ai's real-time alerts notify you when you are approaching the limits of your customized budget. By providing instant notifications, hilm.ai helps users stay on track with their financial plans and avoid overspending.

Hilm.ai tracks and analyzes users' expenses, thereby helping them understand their spending patterns. By instantly categorizing and logging transactions sent via text, voice notes, or receipt photos, it provides insights into where, how, and on what users are spending their money. This facilitates better control over finances and aids users in adjusting their spending habits if needed.

Yes, hilm.ai is designed to help users make informed financial decisions. By analyzing spending patterns, providing personalized financial advice, and tracking progress towards savings goals, hilm.ai provides a comprehensive overview of users' financial behavior, thereby supporting them in making informed decisions about saving, spending, and investing.

Users should choose hilm.ai for their personal finance management due to its unique features tailored specifically for personal finance. It uses AI-powered insights, natural language processing, and integrates with Telegram. Hilm.ai offers automatic transaction logging, personalized financial advice, real-time budget alerts, and comprehensive spending analysis. It's designed to help users understand their spending patterns and make data-driven decisions, setting it apart from other financial tools.

Hilm.ai works on any device, being accessible via Telegram makes it easy for users to manage their finances on the go. They can send their expenses through text messages, voice notes, or by snapping a photo of a receipt, regardless of the device they are using. This feature promotes convenience and accessibility suitable for modern, busy lifestyles.

Hilm.ai is a specialized Artificial Intelligence powered personal finance assistant tool. It enables users to track and manage their personal finances via an interactive and user-friendly approach. The tool offers functions like expense tracking, spending analysis, personalized financial advice, and budget creation and monitoring. It supports different forms of inputs like text, voice, or images of receipts for expense input and uses natural language processing for comprehension and transaction identification. Hilm.ai is designed with integration with Telegram, making it more accessible for users. One of its unique elements includes providing personal finance advice based on user spending patterns, goals, and behavior, helping users make informed decisions and achieve their financial aims.

Hilm.ai integrates with Telegram to provide an accessible and user-friendly platform for users to track and manage their finances. The integration means that users can input expenditure information, receive insights, and interact with the AI assistant directly within the Telegram platform. Hilm.ai delivers services like transaction logging, insights, advice, spending summaries, and financial reports right in users' Telegram.

Users can submit expenses to hilm.ai through several methods. They can send expenses via text messages, voice notes, and receipt photos. Regardless of the format, hilm.ai is equipped to understand and process this information, logging and categorizing the expenses accordingly for further analysis and advice.

Hilm.ai provides a comprehensive analysis of user spending. It includes automatic transaction logging, where it identifies and categorizes all transactions based on the inputs. It offers spending analysis that reveals visible and underlying spending patterns. Personalized insights regarding savings, investments and expense behavior are provided based on these patterns. Hilm.ai also helps in visualizing financial trends and progress tracking over longer durations.

Hilm.ai offers tailored financial advice to its users, derived from their spending data and behavioral patterns. It provides financial planning support through spending reviews, trend visualization, and detailed progress tracking. Besides, it sends daily and weekly financial summaries, and personalised financial recommendations. Advice includes identifying spending trends, suggesting savings or investment opportunities, and providing detailed financial analysis.

Hilm.ai provides extensive support for financial planning. The tool helps users set and track their financial goals. It offers customized budget creation and constant monitoring with real-time alerts as one approaches their preset limits. It lets users visualize spending trends and track their progress through spending reviews. Daily and weekly financial summaries and tailored financial advice also contribute to comprehensive financial planning.

Hilm.ai uses its AI capabilities to automatically track and categorize transactions. Once a user submits an expense via text, voice note, or image of a receipt, the AI identifies and logs the transaction, then categorizes it for analysis and spending review. This automatic logging and categorization of transactions allow for detailed insights and advice.

Hilm.ai does provide real-time alerts as part of its budget-setting feature. It offers custom budget creation and delivers real-time alerts when a user approaches their budget limit, helping them to manage and control their spending effectively.

Some unique features of hilm.ai include its integration with Telegram for accessibility and ease of use, its ability to comprehend diverse input modes like text, voice, or images, and the application of natural language processing for understanding and interacting with users. Hilm.ai also offers automatic transaction logging, personalized financial advice, visual trend analysis, detailed progress tracking, and personalized real-time alerts – all based on an individual user's financial behavior.

Hilm.ai uses AI to underpin all its functionalities. It utilizes natural language processing for comprehending user inputs across diverse modes, including text, voice, and images, and responds to these inputs in a meaningful way. The AI powers the automatic logging and categorization of transactions, as well as the insightful analysis of spending patterns and generation of personalized financial advice.

The primary goal of hilm.ai is to enable users to better understand their spending patterns, track their progress towards financial goals, and make informed decisions about saving, investing, and spending. Through automatic logging of transactions, detailed financial analysis and personalized financial advice, hilm.ai aims to empower users to take control of their financial future.

By 'Natural Language Processing', hilm.ai refers to the AI's ability to understand and interpret human language as it naturally occurs in speech or text. This ability allows the AI to comprehend, respond to, and interact with varying forms of input from users, making the tool more user-friendly and conversational.

Yes, hilm.ai can assist users in understanding their spending habits. Using AI-powered insights and analysis, it sheds light on both visible and underlying spending patterns. This includes the frequency, categories, and amounts of spending, among other factors. Regular financial summaries, detailed transaction logging, and trend visualization aid the user in gaining a comprehensive understanding of their spending habits.

Hilm.ai assists users in making informed financial decisions by providing them with tailored financial advice. This advice is based on the user's unique spending patterns, savings goals, and overall financial behavior. The detailed tracking, analysis, and personalized insights provided by hilm.ai enable users to make well-informed decisions about their saving, spending, and investing.

Hilm.ai excels against a general-purpose AI in that it offers specialized assistance for personal finance. Unlike general-purpose AI, hilm.ai leverages AI capabilities like natural language processing to understand and respond to user inputs related to finance. Its intelligent solution offers detailed insights into spending patterns and behavior, personalized financial advice, and comprehensive financial planning support.

Hilm.ai is a great solution for managing personal finances because of its specialized and user-focused features. It encompasses automatic logging and categorization of transactions, detailed and insightful spending analysis, tailored financial advice, and customizable budgeting with real-time alerts. Its ability to process various forms of input, use natural language processing, and integrate with Telegram for accessibility adds to its effectiveness in personal finance management.

Hilm.ai provides support for setting and monitoring budgets. It offers a feature that allows users to create custom budgets for different spending categories. Real-time alerts are provided when the user is approaching their set budget limits, helping them stay on track with their financial plan.

While the information provided about hilm.ai doesn't explicitly mention investing insights, the tool does offer personalized financial advice based on users' financial behavior. This could likely include insights and recommendations on investment opportunities and strategies suited to the individual's financial habits, goals, and situation.

The primary difference between hilm.ai and ChatGPT for personal finance lies in their design and functionality. Hilm.ai is a specialized AI personal finance assistant designed explicitly for expense tracking and financial management. In contrast, ChatGPT is a general-purpose AI not intended or equipped for direct financial data access or real-time insights regarding user spending. Hilm.ai automatically categorizes transactions, provides personalized insights based on spending patterns, and offers features like receipt scanning and voice expense logging, which are not provided by a general AI like ChatGPT.

Yes, hilm.ai can function as a voice interactive tool. It accepts input in the form of voice notes as a part of its different input methods. Users can express their expenses through voice notes, and the AI will understand, process, and log the expense details accordingly.

Pricing

Pricing model

Free Trial

Paid options from

$16/month

Billing frequency

Monthly

Refund policy

No Refunds