Overview

- Verify an individual's identity and background in under 20 seconds using just a photo, powered by instant facial recognition and real-time web scraping.

- Receive a comprehensive risk score for informed decision-making, based on AI analysis of PEP status, criminal records, sanctions, and high-risk industry associations.

- Prevent fraud and financial crime by detecting discrepancies in claims, screening for past fraud records, and identifying potential cryptocurrency involvement.

- Conduct legally compliant background checks for employee screening or client onboarding, with processing that requires consent and adheres to GDPR/CCPA standards.

- Integrate real-time identity verification directly into your platforms via a REST API, enabling automated KYC checks within your own workflows.

Pros & Cons

Pros

- KYC reports generation

- Facial recognition for identity verification

- Real-time online data scraping

- Broad application in various sectors

- Risk prevention and assessment

- Comprehensive report in 20 seconds

- Privacy and legality assurance

- Background screenings for recruitment

- Cryptocurrency involvement identification

- PEP status identification

- Detection of potential criminality

- Sanctions and associations screening

- High-risk Industry Associations evaluation

- Instant facial recognition search

- Large Language Models for data collection

- Rapid data processing

- Risk Scoring for individuals

- Personal information gathering

- Known associations investigation

- Efficient fraud prevention tool

- API for easy integration

- Consent-based services

- 92.7% accuracy in high-risk individual detection

- 300+ million pages indexed for personal info

- No documents required for verification

- Policy compliance (GDPR, CCPA, AML)

- No client's data stored or reused

- In-memory photo processing

- Encrypted transmissions (TLS 1.3)

- Regional hosting options for data sovereignty

- Server hosting based in the EU

- Clear and well-structured API documentation

- Fast and consistent response times

- Dedicated support for enterprise teams

- Easy integration with CRMs, fintech tools, internal portals

- Scalable for startups to global institutions

- Pre-screening tool for recruitment

- White collar crime records check

- Online image locating

- Automatic online data collation

- High-speed report delivery

- Non-Doc Verification feature

- Evaluable trustworthiness and personal identity

- High-risk individual screening

- Potential cryptocurrency involvement checking

- Prevention of financial fraud

- Prevention of money laundering in gambling industry

- Protecting online businesses using facial recognition

- Verifying credibility of potential landlords, tenants

- Detecting mortgage fraud, rental scams

- Interactive risk assessment tool

- User-friendly platform for background checks

Cons

- Only utilises public data

- Dependent on image quality

- Limited to online presence

- Requires explicit consent

- Possible biases in facial recognition

- Needs strong internet connection

- Potential for false positives

- 20 seconds processing time

- Lack of offline functionality

- Data privacy issues

Reviews

Rate this tool

Loading reviews...

❓ Frequently Asked Questions

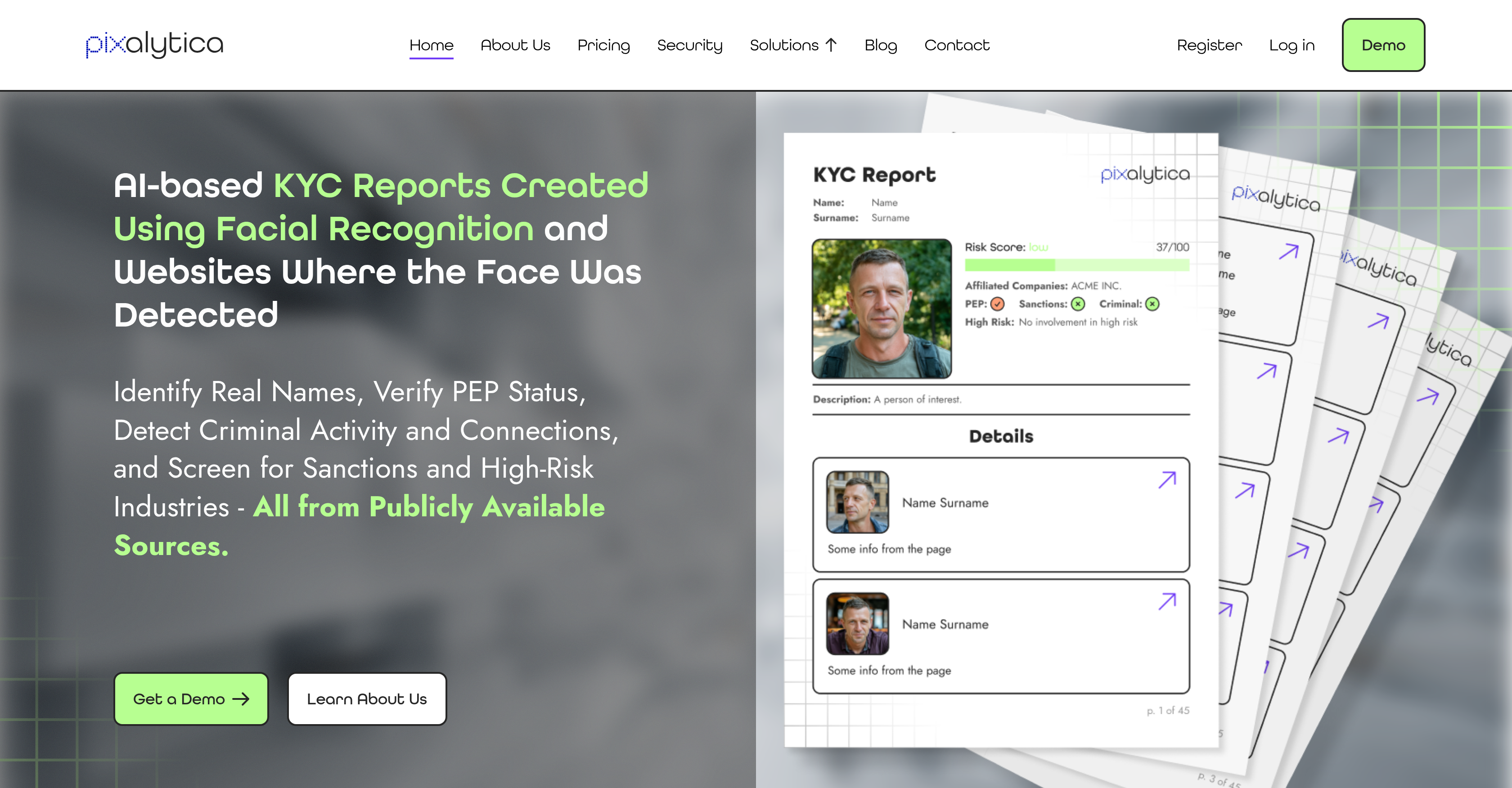

Pixalytica is an AI tool designed for performing Know Your Customer (KYC) reports using facial recognition technology. The tool aims to verify the identity, potential risks, and background of individuals. Once a photo is submitted, Pixalytica initiates a real-time web scraping process that identifies any online presence of the uploaded face. The resulting report is comprehensive, including personal details, known associations, and a risk scoring.

Pixalytica uses facial recognition technology to match an uploaded user photo with images available online. It uses this technology to verify the identity of the person in the photo and provides a comprehensive report based on the information it gathers.

No, Pixalytica is not limited to specific industries. It is applicable across various sectors like Fintech, Cryptocurrency, Cybersecurity, Insurance, Real Estate, e-commerce, and several others.

Pixalytica aims to prevent fraud by verifying identities, background screening, and detecting any potential risks tied to a person. It checks for fraudulent patterns and potential risks through its AI-driven large language models and provides a risk score for every individual it investigates.

To submit a photo to Pixalytica, a user uploads a photo through the user panel or via an API request. No identification documents are needed, as the face in the image is sufficient.

Once a photo is submitted, Pixalytica initiates a real-time process that scrapes the web for any online presence of the uploaded face. This involves using advanced large language models and AI analysis to collate available online data associated with the face.

Pixalytica provides a comprehensive report, including personal details, known associations, and a risk scoring. It collects and analyses information such as PEP status, criminal records, sanctions, associations, and other relevant data found online.

Pixalytica generates a responsive and detailed report in less than 20 seconds.

Yes, Pixalytica complies with legal standards and data protection regulations. It requires the user's consent or a legal basis to use the service, ensuring privacy, and legality.

Pixalytica can be used for risk assessment by collating various pieces of information like PEP status, criminal records, sanctions, and associations for an individual. It then provides a risk score as part of its report, assisting in effective risk assessment and prevention.

Yes, Pixalytica can identify potential involvement in cryptocurrency. It includes in its report any detected cryptocurrency activities linked with the individual being checked.

Pixalytica aids decision-making processes by providing factual, objective data about individuals. It verifies claims and helps detect discrepancies, therefore offering valuable insights in decision-making processes related to fraud prevention, risk assessment, employee recruitment, and more.

Pixalytica verifies the identity of an individual by comparing an uploaded picture to online images. It uses a powerful facial recognition engine to match these images and then uses its AI-driven models to compile relevant online data associated with the identified individual.

Yes, Pixalytica operates in real-time. Once an image is uploaded, it instantly initiates an intelligent web scraping process to find the online presence of the face in the image. In less than 20 seconds, a comprehensive report is generated.

Yes, Pixalytica can be integrated via API. The platform provides a REST API, allowing users to integrate identity risk scoring, facial analysis, and real-time KYC verification directly into their own platforms, dashboards, or onboarding systems.

Pixalytica boasts an impressive 92.7% accuracy in high-risk individual detection, providing highly accurate identity verification from publicly available sources.

Yes, Pixalytica provides a measure of risk with its reports. The AI tool investigates an individual's online presence, criminal records, sanctions, associations, and other potential risks, and consolidates these pieces of information into a risk score.

Yes, Pixalytica can be used for background screenings of potential employees. It offers a quick, identity verification solution that is useful in pre-screening recruitment processes, helping to ensure that potential candidates meet necessary eligibility criteria.

Pixalytica's KYC reports are comprehensive, including identity verification, PEP status, criminal records, sanctions, known associations, risk scoring, and an overview of sources where the facial images were found. It may also include detection of cryptocurrency activity, fraud detection, and criminal associations.

Pixalytica places a considerable emphasis on data privacy and user consent. It abides by regulations surrounding data privacy like GDPR, CCPA, and AML, and requires either the user's consent or a legal basis to use the service. Pixalytica guarantees that no client data is stored or reused, and all photo processing occurs in-memory with encrypted transmissions.

Pixalytica is an AI-based tool that utilizes facial recognition technology for Know Your Customer (KYC) reporting. It is designed primarily for identity verification, with capabilities to perform comprehensive background checks, verification of Politically Exposed Person (PEP) status, detection of potential criminal activity or connections, and screening for sanctions and associations with high-risk industries. Furthermore, Pixalytica finds application in risk assessment, fraud prevention, background screenings, and the detection of potential involvement in cryptocurrency.

Pixalytica uses facial recognition technology to initiate a real-time search that identifies any online presence of the uploaded face. Once a photo is submitted through the user panel or via an API request, Pixalytica’s technology located online images of the person. It utilizes this information, in combination with its advanced large language models and AI analysis, to gather and process data associated with the individual's online presence.

Pixalytica can deliver a comprehensive KYC report in less than 20 seconds. This rapid data processing results in a complete report that includes relevant personal information, known associations, and risk scoring.

Yes, Pixalytica’s service is legal and fully compliant with privacy laws. Its operation requires the consent of the user or a legal basis for services. It has been built with data protection and regulatory standards in mind.

Pixalytica utilizes advanced AI-driven large language models and real-time web scraping to collate and analyze online data associated with the individual’s online presence. This data includes PEP status, mentions of criminal records, sanctions, associations, and more. By processing this information, Pixalytica can identify and assess potential risks associated with the individual.

Pixalytica serves various sectors like Fintech, Cryptocurrency, Cybersecurity, Insurance, Real Estate, e-commerce, and several others. It is suitable to any industry that requires identity verification, risk assessment, fraud prevention, and background screenings.

Yes, Pixalytica can detect potential involvement in cryptocurrency. It incorporates a functionality that assesses an individual’s potential involvement with blockchain activities. This is part of their data collation, analysis, and risk assessment.

Pixalytica uses data from publicly available sources, which is collected and analyzed through instant facial recognition searches, online image locating, large language models, and AI analysis. This data includes online data like PEP status, criminal records, sanctions, associations, and any other online presence that can be linked to the uploaded face.

To initiate identity verification with Pixalytica, a user needs to upload the image in their user panel or send an API request with the individual's image. Pixalytica then initiates an instant facial recognition search that identifies any online presence of the uploaded face. In less than 20 seconds, the user receives a comprehensive report.

Pixalytica handles user consent by requiring it or another legal basis for services before using the tool. It is the responsibility of the user, when signing the agreement with Pixalytica, to guarantee that they have the consent of the entity to use the service.

Pixalytica's report includes personal information, known associations, risk scoring, image sources, similarity score, PEP status, detection of sanction records and criminal associations, possible cryptocurrency activity, and other relevant details. The report also provides a profile summary, possible white-collar crime records, and findings related to suspected criminal activity.

Yes, Pixalytica can be used for employee background screenings. It facilitates performing comprehensive background checks for recruitment processes, assisting businesses in identifying any potential risks linked to prospective employees.

Pixalytica can help prevent financial fraud by screening for possible criminal activity and past fraud records. Its advanced AI-driven models analyze publicly available online data that can help identify irregularities and potential red flags associated with an individual.

Yes, Pixalytica can detect association with high-risk industries. Its KYC reports include screenings for such associations. By processing publicly available data using AI analysis, it can detect and highlight any links of the individual with industries categorized as high-risk.

Pixalytica ensures the accuracy of its results through sophisticated technology, including AI-driven large language models and real-time web scraping. It claims a 92.7% accuracy in high-risk individual detection.

Pixalytica's approach to privacy law compliance involves operation under user consent or another legal basis for the services it offers. It is built with consideration for data protection and regulatory standards, ensuring that it complies fully with GDPR, CCPA, and AML architecture. The service ensures no client data are stored or reused and all photo processing happens in-memory.

Within Fintech and e-commerce sectors, Pixalytica serves as a reliable asset in decision-making, risk assessment, and fraud prevention. It enables businesses to verify the true identities of their clients and cross-check their claims with their online presence. Pixalytica also helps detect potential financial fraud and suspicious activity, strengthening the overall cybersecurity of a company.

Pixalytica assists in identity verification for Real Estate transactions by determining the true identities of potential landlords or tenants. It helps detect mortgage fraud, rental scams, predatory loans, and more by analysing the online profiles of individuals involved in the transaction.

Pixalytica's AI analysis is highly reliable, backed by advanced large language models that can decipher and collate relevant information from a wide array of publicly available sources. Pixalytica claims an accuracy level of 92.7% in high-risk individual detection, showcasing the precision of its sophisticated AI-driven models.

Yes, Pixalytica offers a REST API that allows direct integration into your own platforms, dashboards, or onboarding systems. Its API is geared towards developers with features like clear and well-structured documentation, RESTful architecture for easy integration, fast response times, and dedicated support for enterprise teams.

Pixalytica provides a comprehensive report, including personal details, known associations, and a risk scoring. It collects and analyses information such as PEP status, criminal records, sanctions, associations, and other relevant data found online.

Pixalytica generates a responsive and detailed report in less than 20 seconds.

Yes, Pixalytica complies with legal standards and data protection regulations. It requires the user's consent or a legal basis to use the service, ensuring privacy, and legality.

Pixalytica can be used for risk assessment by collating various pieces of information like PEP status, criminal records, sanctions, and associations for an individual. It then provides a risk score as part of its report, assisting in effective risk assessment and prevention.

Yes, Pixalytica can identify potential involvement in cryptocurrency. It includes in its report any detected cryptocurrency activities linked with the individual being checked.

Pixalytica aids decision-making processes by providing factual, objective data about individuals. It verifies claims and helps detect discrepancies, therefore offering valuable insights in decision-making processes related to fraud prevention, risk assessment, employee recruitment, and more.

Pixalytica verifies the identity of an individual by comparing an uploaded picture to online images. It uses a powerful facial recognition engine to match these images and then uses its AI-driven models to compile relevant online data associated with the identified individual.

Yes, Pixalytica operates in real-time. Once an image is uploaded, it instantly initiates an intelligent web scraping process to find the online presence of the face in the image. In less than 20 seconds, a comprehensive report is generated.

Yes, Pixalytica can be integrated via API. The platform provides a REST API, allowing users to integrate identity risk scoring, facial analysis, and real-time KYC verification directly into their own platforms, dashboards, or onboarding systems.

Pixalytica boasts an impressive 92.7% accuracy in high-risk individual detection, providing highly accurate identity verification from publicly available sources.

Yes, Pixalytica provides a measure of risk with its reports. The AI tool investigates an individual's online presence, criminal records, sanctions, associations, and other potential risks, and consolidates these pieces of information into a risk score.

Yes, Pixalytica can be used for background screenings of potential employees. It offers a quick, identity verification solution that is useful in pre-screening recruitment processes, helping to ensure that potential candidates meet necessary eligibility criteria.

Pixalytica's KYC reports are comprehensive, including identity verification, PEP status, criminal records, sanctions, known associations, risk scoring, and an overview of sources where the facial images were found. It may also include detection of cryptocurrency activity, fraud detection, and criminal associations.

Pixalytica places a considerable emphasis on data privacy and user consent. It abides by regulations surrounding data privacy like GDPR, CCPA, and AML, and requires either the user's consent or a legal basis to use the service. Pixalytica guarantees that no client data is stored or reused, and all photo processing occurs in-memory with encrypted transmissions.

Pixalytica is an AI-based tool that utilizes facial recognition technology for Know Your Customer (KYC) reporting. It is designed primarily for identity verification, with capabilities to perform comprehensive background checks, verification of Politically Exposed Person (PEP) status, detection of potential criminal activity or connections, and screening for sanctions and associations with high-risk industries. Furthermore, Pixalytica finds application in risk assessment, fraud prevention, background screenings, and the detection of potential involvement in cryptocurrency.

Pixalytica uses facial recognition technology to initiate a real-time search that identifies any online presence of the uploaded face. Once a photo is submitted through the user panel or via an API request, Pixalytica’s technology located online images of the person. It utilizes this information, in combination with its advanced large language models and AI analysis, to gather and process data associated with the individual's online presence.

Pixalytica can deliver a comprehensive KYC report in less than 20 seconds. This rapid data processing results in a complete report that includes relevant personal information, known associations, and risk scoring.

Yes, Pixalytica’s service is legal and fully compliant with privacy laws. Its operation requires the consent of the user or a legal basis for services. It has been built with data protection and regulatory standards in mind.

Pixalytica utilizes advanced AI-driven large language models and real-time web scraping to collate and analyze online data associated with the individual’s online presence. This data includes PEP status, mentions of criminal records, sanctions, associations, and more. By processing this information, Pixalytica can identify and assess potential risks associated with the individual.

Pixalytica serves various sectors like Fintech, Cryptocurrency, Cybersecurity, Insurance, Real Estate, e-commerce, and several others. It is suitable to any industry that requires identity verification, risk assessment, fraud prevention, and background screenings.

Yes, Pixalytica can detect potential involvement in cryptocurrency. It incorporates a functionality that assesses an individual’s potential involvement with blockchain activities. This is part of their data collation, analysis, and risk assessment.

Pixalytica uses data from publicly available sources, which is collected and analyzed through instant facial recognition searches, online image locating, large language models, and AI analysis. This data includes online data like PEP status, criminal records, sanctions, associations, and any other online presence that can be linked to the uploaded face.

To initiate identity verification with Pixalytica, a user needs to upload the image in their user panel or send an API request with the individual's image. Pixalytica then initiates an instant facial recognition search that identifies any online presence of the uploaded face. In less than 20 seconds, the user receives a comprehensive report.

Pixalytica handles user consent by requiring it or another legal basis for services before using the tool. It is the responsibility of the user, when signing the agreement with Pixalytica, to guarantee that they have the consent of the entity to use the service.

Pixalytica's report includes personal information, known associations, risk scoring, image sources, similarity score, PEP status, detection of sanction records and criminal associations, possible cryptocurrency activity, and other relevant details. The report also provides a profile summary, possible white-collar crime records, and findings related to suspected criminal activity.

Yes, Pixalytica can be used for employee background screenings. It facilitates performing comprehensive background checks for recruitment processes, assisting businesses in identifying any potential risks linked to prospective employees.

Pixalytica can help prevent financial fraud by screening for possible criminal activity and past fraud records. Its advanced AI-driven models analyze publicly available online data that can help identify irregularities and potential red flags associated with an individual.

Yes, Pixalytica can detect association with high-risk industries. Its KYC reports include screenings for such associations. By processing publicly available data using AI analysis, it can detect and highlight any links of the individual with industries categorized as high-risk.

Pixalytica ensures the accuracy of its results through sophisticated technology, including AI-driven large language models and real-time web scraping. It claims a 92.7% accuracy in high-risk individual detection.

Pixalytica's approach to privacy law compliance involves operation under user consent or another legal basis for the services it offers. It is built with consideration for data protection and regulatory standards, ensuring that it complies fully with GDPR, CCPA, and AML architecture. The service ensures no client data are stored or reused and all photo processing happens in-memory.

Within Fintech and e-commerce sectors, Pixalytica serves as a reliable asset in decision-making, risk assessment, and fraud prevention. It enables businesses to verify the true identities of their clients and cross-check their claims with their online presence. Pixalytica also helps detect potential financial fraud and suspicious activity, strengthening the overall cybersecurity of a company.

Pixalytica assists in identity verification for Real Estate transactions by determining the true identities of potential landlords or tenants. It helps detect mortgage fraud, rental scams, predatory loans, and more by analysing the online profiles of individuals involved in the transaction.

Pixalytica's AI analysis is highly reliable, backed by advanced large language models that can decipher and collate relevant information from a wide array of publicly available sources. Pixalytica claims an accuracy level of 92.7% in high-risk individual detection, showcasing the precision of its sophisticated AI-driven models.

Yes, Pixalytica offers a REST API that allows direct integration into your own platforms, dashboards, or onboarding systems. Its API is geared towards developers with features like clear and well-structured documentation, RESTful architecture for easy integration, fast response times, and dedicated support for enterprise teams.

Pricing

Pricing model

Paid

Paid options from

$79.99/month

Billing frequency

Monthly